IN THIS ARTICLE

How Edgewater Property Management Automated Their Rent Distribution In 48 Hours

The Company: Edgewater Property Management operates 24 commercial properties across the Mid-Atlantic region: office buildings, retail centers, and mixed-use developments. They collect around $4.2M in monthly rent from 180 tenants.

The Problem: Every month, Edgewater’s finance and operations team spent 40+ hours manually distributing rent payments across different accounts. When a new $12,000 rent payment came in from a tenant at their Baltimore office building, someone had to:

- Calculate the mortgage payment portion

- Set aside reserves for capital improvements

- Allocate funds for operating expenses

- Determine what was left for owner distributions

With 180 tenants paying on different schedules, this meant constant spreadsheet updates, manual wire initiations, and plenty of room for human error.

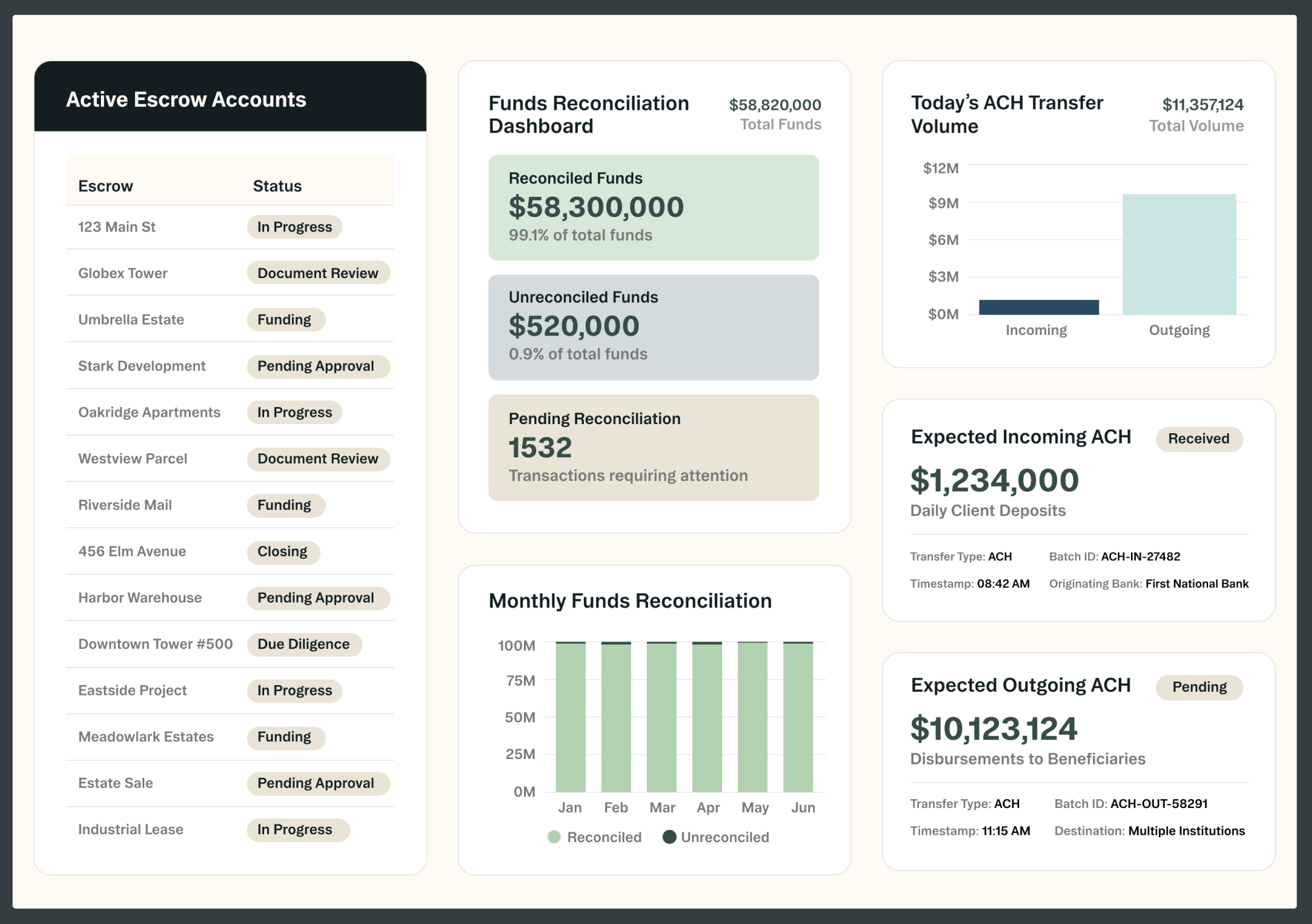

The Hudson Solution

Step 1: Creating the Structure (15 minutes per property)

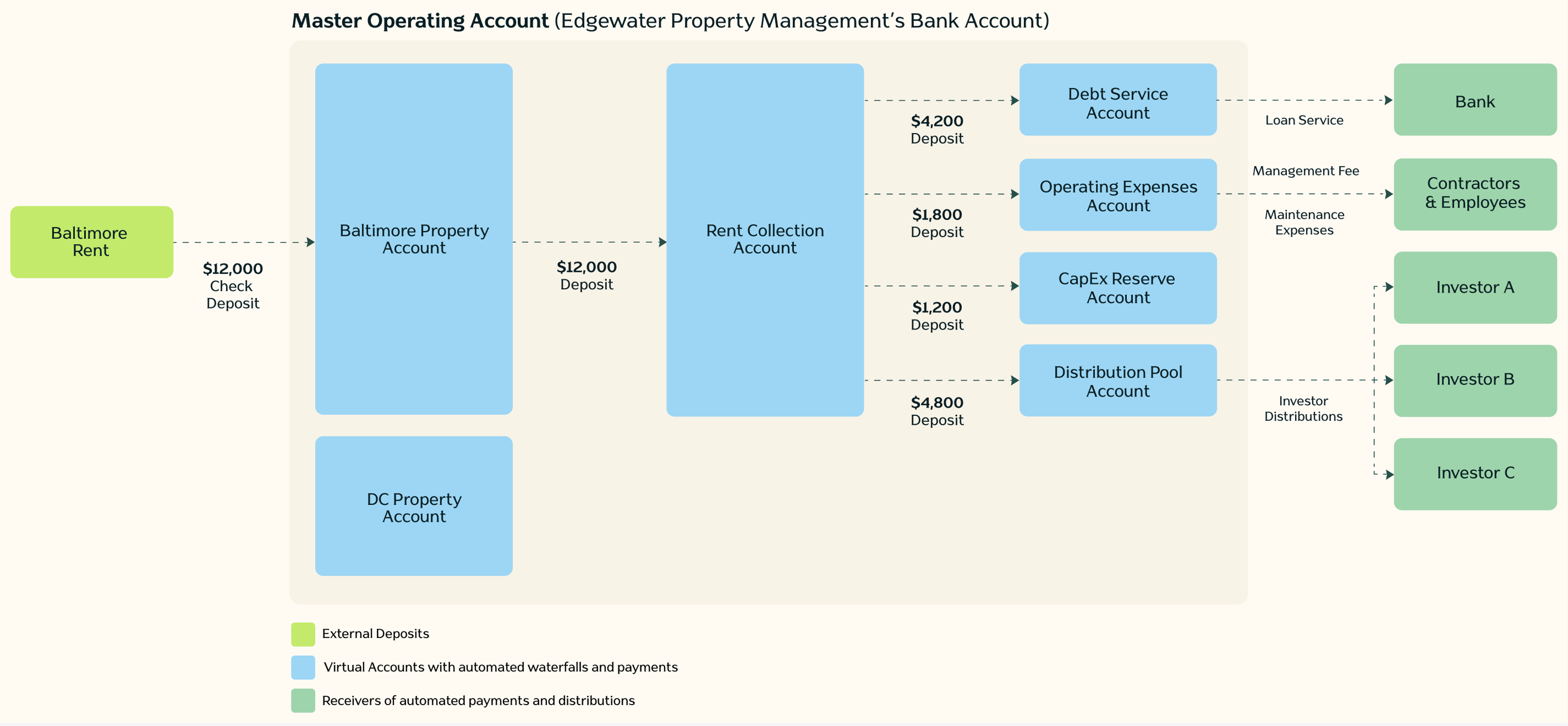

Edgewater’s bank created one master operating account. Through Hudson, they also built virtual accounts for each property and purpose:

Baltimore Office Building Structure:

These virtual accounts track funds separately but live within the same FDIC-insured account. No new account applications, no additional monthly fees...

Step 2: Programming the Waterfall Rules (30 minutes per property)

Edgewater uploaded their property operating agreement, and Hudson's rules engine extracted the payment hierarchy. For the Baltimore building, it looked like this:

When rent is received:

- 35% → Debt Service (mortgage payment due the 1st)

- 15% → Operating Expenses (property management, utilities, insurance)

- 10% → CapEx Reserve (locked until approved expenditure)

- 40% → Distribution Pool (available for owner distributions)

The system then scheduled automatic payments - mortgage on the 1st, property management fees on the 5th, utility bills as they arrive.

Step 3: The System in Action

When that $12,000 tenant payment hits via ACH, here's what happens automatically:

9:00 AM - Payment Received

- $12,000 lands in Rent Collection account

- Edgewater gets a notification: "Tenant 3B payment received"

9:00 AM - Instant Distribution (within seconds)

- $4,200 → Debt Service account

- $1,800 → Operating Expenses account

- $1,200 → CapEx Reserve account

- $4,800 → Distribution Pool account

Throughout the Month - Automated Payments

- 1st of month: Hudson initiates mortgage payment from Debt Service account

- 5th of month: Property management fee paid from Operating Expenses

- As needed: Approved maintenance expenses paid from Operating Expenses

- Quarterly: Investor distributions calculated and sent from Distribution Pool

The property manager doesn't touch any of this. They simply approve one-time expenses through a dashboard when something breaks or needs repair.

The Impact

Time Savings: That 40-hour monthly reconciliation process? Down to 3 hours of reviewing reports and approving exceptions.

Cash Visibility: Edgewater’s CEO can now log in and see real-time balances across all 24 properties, every account, every allocation. No more waiting for month-end reports to understand cash position.

Error Reduction: In their first six months, Edgewater eliminated 100% of their rent distribution errors. The math is programmed once and executes every time.

Bank Relationship: Their bank captured all $4.2M in monthly rent flow (previously split across three different banks) and now earns transaction fees on 180+ automated rent collections monthly. Edgewater gets better service as a more valuable client.

Why it Works for Both Banks and Asset Managers

The platform knows their operating agreements, understands the payment hierarchy, and executes flawlessly without human intervention.

For their bank, this transformed Edgewater from a customer with scattered deposits into a relationship generating $50M+ in annual deposit flow through a single master account, with substantially higher fee income and virtually zero switching risk.

Hudson Technology Systems provides contract payment automation for financial institutions. Our platform turns operating agreements into executable payment workflows, helping banks capture and retain commercial real estate relationships.